The PMR Chartist #2

Best charts I stumbled upon today...

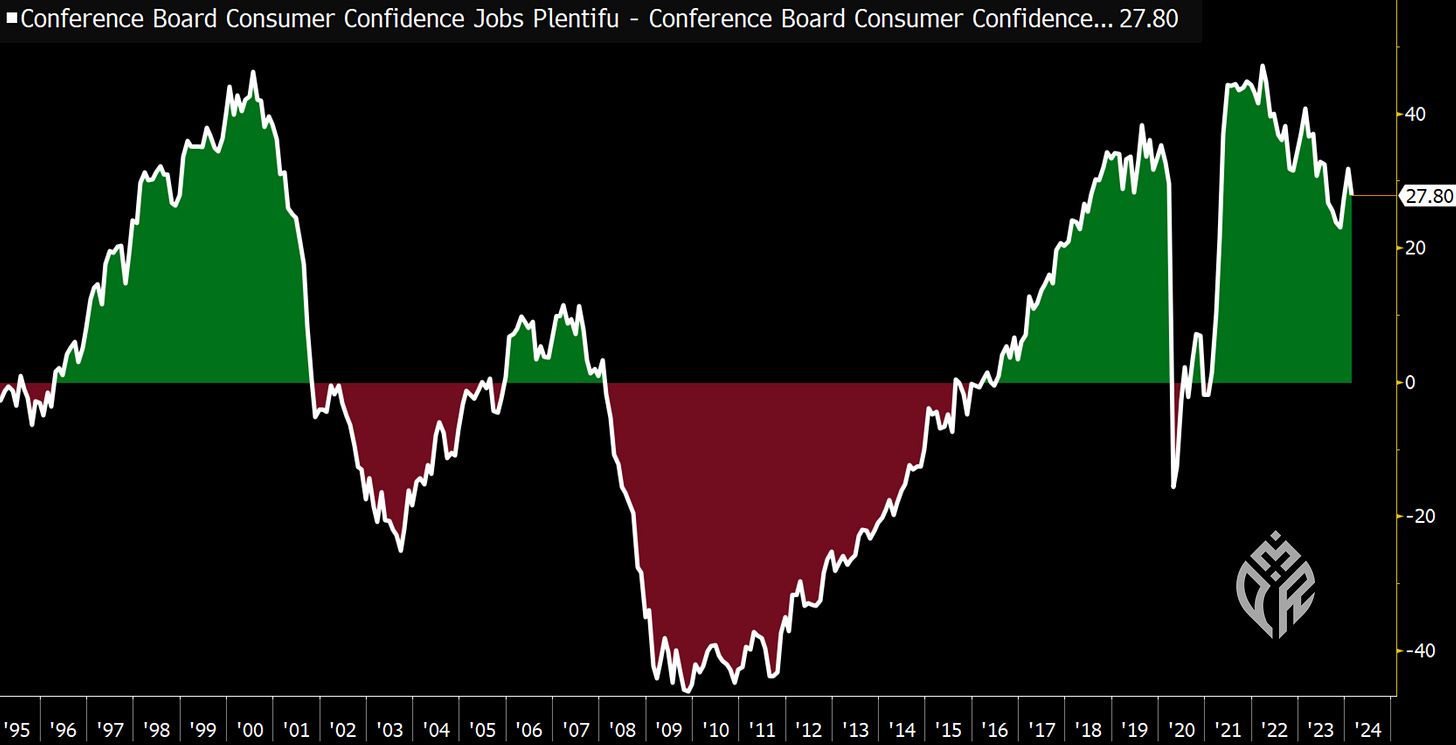

Moved back lower on labor differential, suggesting the unemployment rate moving higher soon (above 4%).

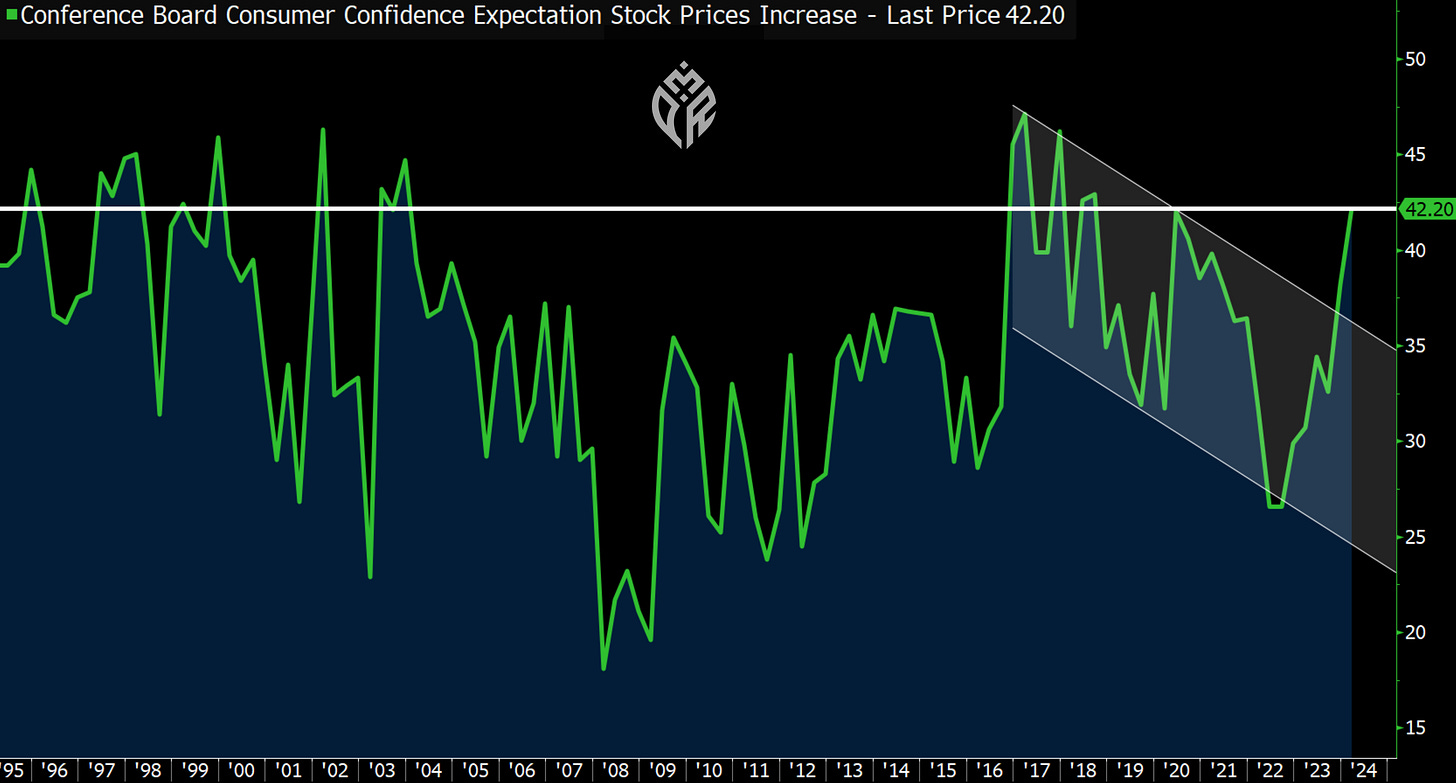

Consumer confidence fell today but stock price expectations did NOT.

Home prices still going up, but barely on a MoM basis.

The Atlanta Fed raised their Q1 growth estimate back above 3% to 3.16% with residential investment driving the jump.

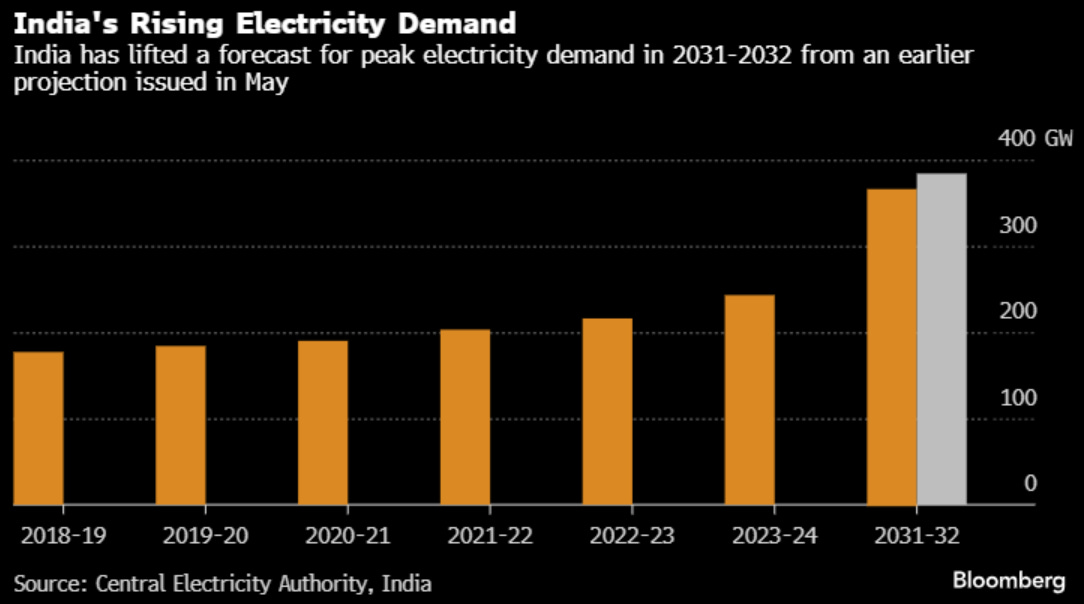

That is a lot of power. Even with rapidly growing non fossil fuel power, it is difficult to fill that gap without more fossil fuels.

Sentiment is sporty but may have a little room left before everyone realizes which side of the boat everyone else is on.

Global internals have been strong over the last year.

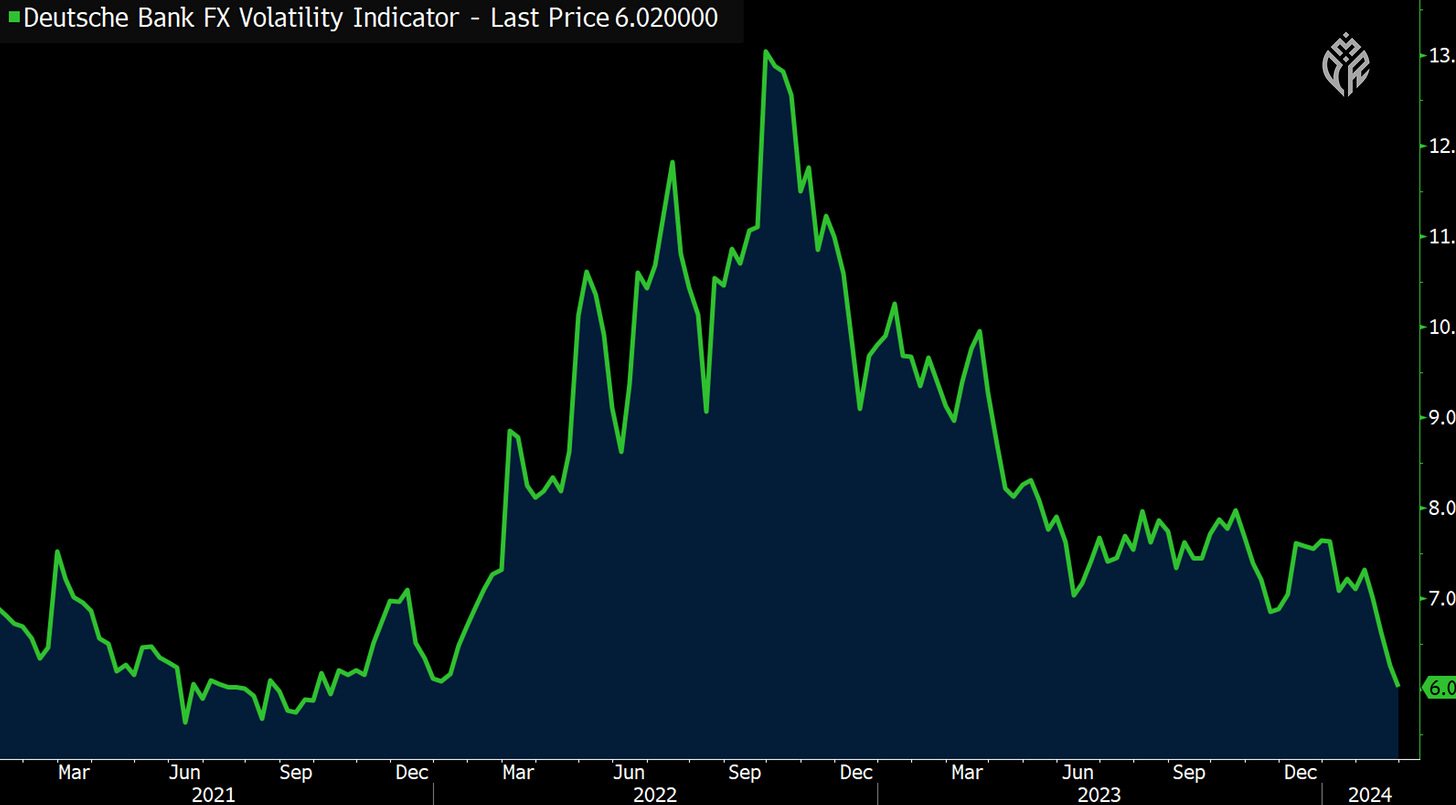

FX vol has fallen off a cliff over the last month.

Everyone has seen the BBG Commodity chart by now - here is how they are all doing YTD. Also, corn is worse than natural gas over the last year!

Speaking of commodities - check out the breakout in cotton.

European equities (led by GRANOLAS) are off to a great start to the year but even they are trailing MAG7 by a ton.

XBI with a strong month so far and a great year. Biotech *could* end up being a big AI winner in the end and has been beaten up of late so it will be interesting to see if this move can have legs.

Disclosure: Pinecone Macro Research, LLC is an independent research firm. Pinecone Macro’s letters are based upon information gathered from various sources believed to be reliable but are not guaranteed as to accuracy or completeness. There are risks in investing. Any individual report is not all-inclusive and does not contain all of the information that you may desire in making an investment decision. You must conduct and rely on your own evaluation of any potential investment and the terms of its offering, including the merits and risks involved in making a decision to invest. The information in this letter is not intended to be, and shall not constitute, an offer to sell or a solicitation of an offer to buy any security or investment product or service. The information in this report is subject to change without notice, and Pinecone Macro Research, LLC assumes no responsibility to update the information contained in this report. There is risk in trading markets. Pinecone Macro Research, LLC is not an investment advisor. The ideas and trades I share are my own and are for informational and educational purposes only and should not be construed as investment advice. Accordingly, you should not rely solely on the information in making any investment. You should always check with your licensed financial advisor to determine the suitability of any investments.