Yesterday and Today’s Data:

Had to share this one as it fits closely with my own view I have been writing about regarding financial conditions. I do not think the Fed grasps just how stimulative loose financial conditions have become and I think it helps explains growth.

The last four times financial conditions eased as much as they did QoQ in Q4 of 2024, every measure of the economy firmed up as did inflation. Below is two of a few examples I gave in a recent Emerald I wrote about how things are similar to 1998:

Oil inventories added about 4.2 million barrels on the week, largely thanks to refineries moving slowly right now which has led to significant draws in product inventories. Oil is a touch above the 10yr average but below last year’s levels while products are all now below the 10yr average.

Oil has perked up of late (not just price but time spreads and crack spreads etc.) but energy stocks continue to be sold/ignored/cheap.

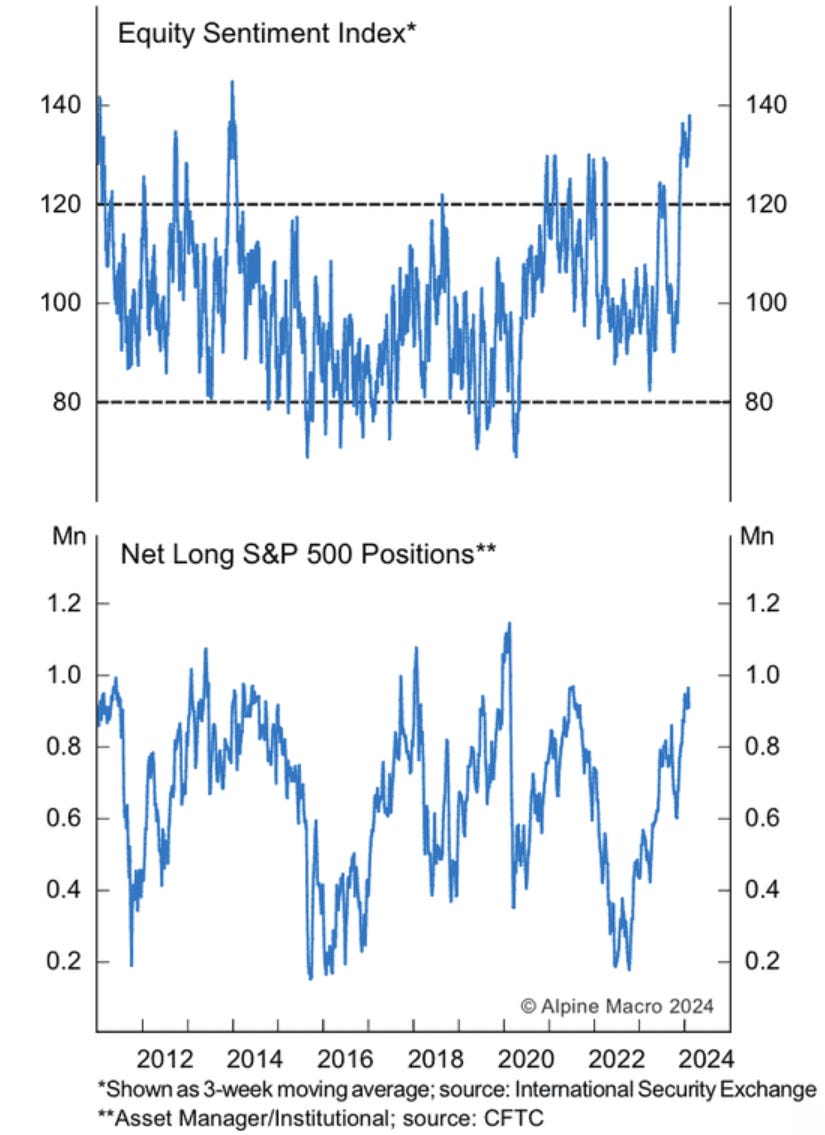

Your daily reminder than sentiment and positioning are quite bullish.

So far is the key here - cutting into strength would be a repeat error. But to the Fed’s credit they have slid cutting to the right and started to sound a touch concerned with the path back to target.

The problem here is that bank credit growth matter much more in the 1970s than it does today. Giant fiscal deficits and private credit happy to step in for banks makes it matter less. I think financING conditions are tight but financIAL conditions are very loose and right now the conditions matter more.

Since the start of the year, we have 2.8 less cuts priced in Europe and 2.4 less cuts priced in the US (by the end of 2024).

Starting to think semis are getting a touch frothy…

Non fossil fuel energy has done so well of late in Europe that carbon credits have gotten much cheaper. Less industrial output of course helped too.

Not shocking but cutting into strength is bullish. We average being up 15% a year after a no recession cut.

CEOs and CFOs getting excited now that everything is going great thanks to the Fed’s Q4 asset price Pivot Party.

The focus continues to be on office real estate but without rate cuts multifamily is in major trouble.

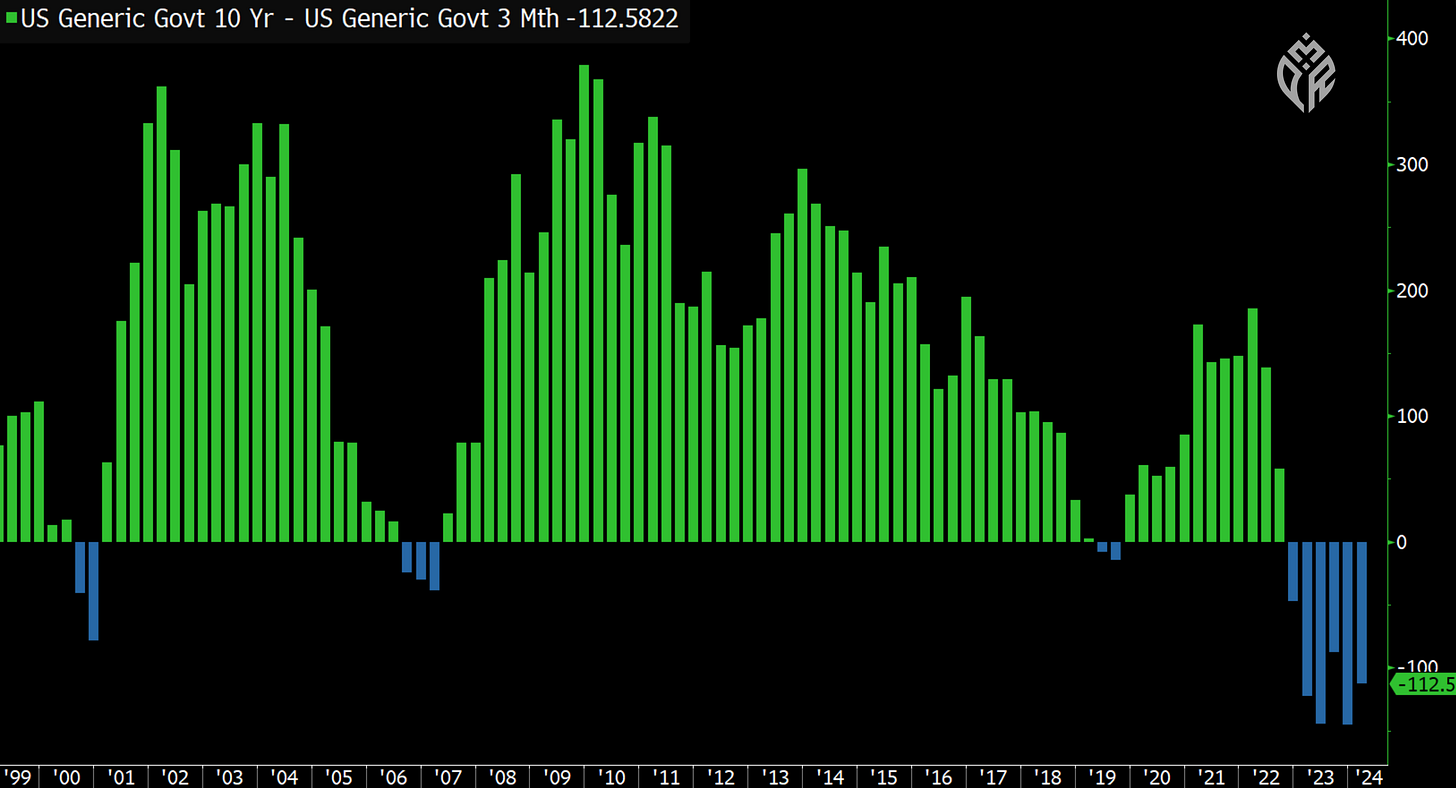

The 3M10Y curve is still over 1% inverted and 2s10s have gone from only 16bps inverted back to 38bps inverted in the last six weeks.

Prices on office buildings are of course collapsing (because of the way they are financed mostly). This plus that 3M10Y in combination is a tough brew for smaller banks.

Low rates incentivized companies to issue debt and not shares. That looks to be flipping which may lead to a lot more equity supply in the future.

China’s oil inventories suggesting strong import demand moving forward.

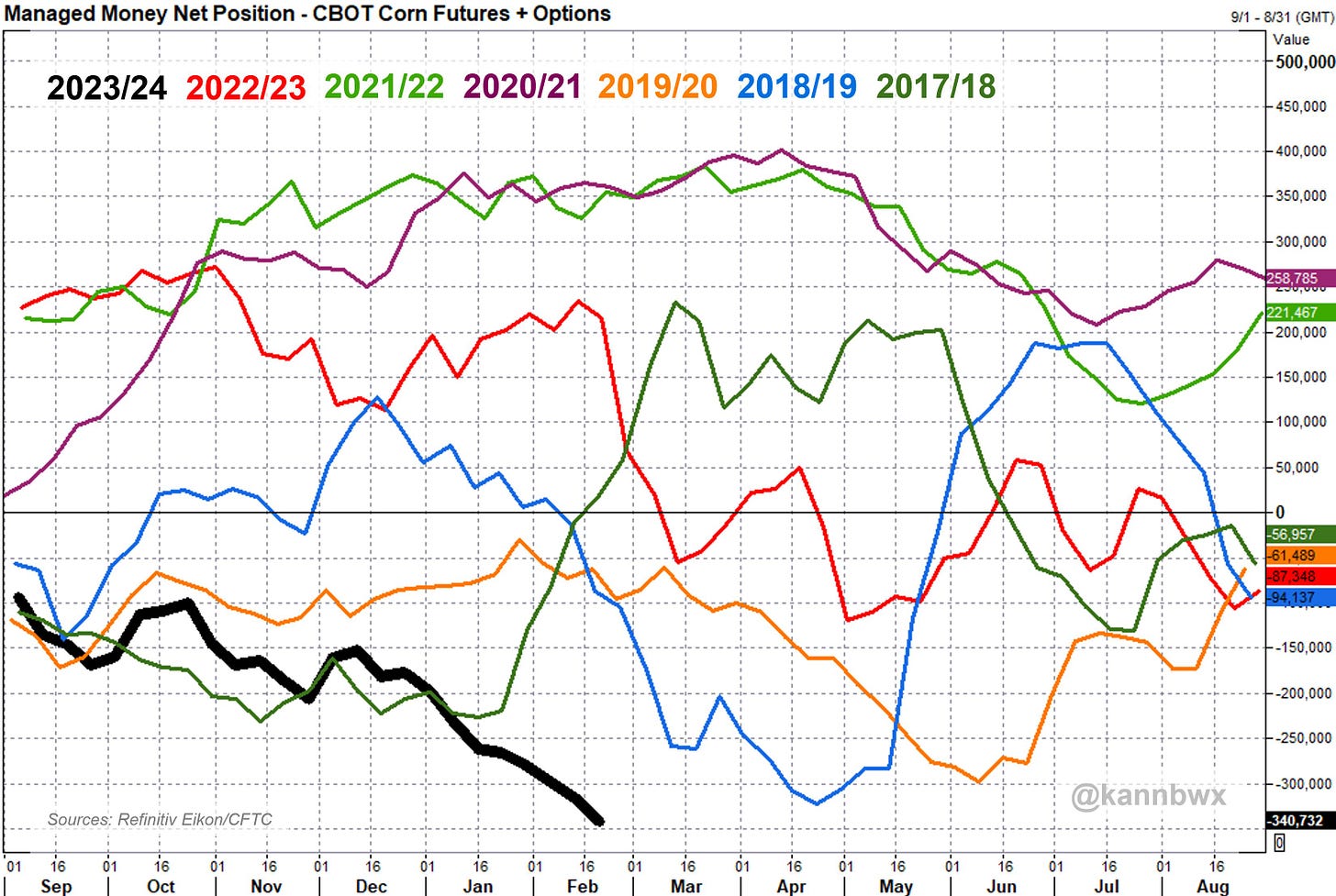

Funds are VERY short corn…

Oil tested a higher high/breakout today and failed. Can we take that out and get to $80 before the week is over?

Disclosure: Pinecone Macro Research, LLC is an independent research firm. Pinecone Macro’s letters are based upon information gathered from various sources believed to be reliable but are not guaranteed as to accuracy or completeness. There are risks in investing. Any individual report is not all-inclusive and does not contain all of the information that you may desire in making an investment decision. You must conduct and rely on your own evaluation of any potential investment and the terms of its offering, including the merits and risks involved in making a decision to invest. The information in this letter is not intended to be, and shall not constitute, an offer to sell or a solicitation of an offer to buy any security or investment product or service. The information in this report is subject to change without notice, and Pinecone Macro Research, LLC assumes no responsibility to update the information contained in this report. There is risk in trading markets. Pinecone Macro Research, LLC is not an investment advisor. The ideas and trades I share are my own and are for informational and educational purposes only and should not be construed as investment advice. Accordingly, you should not rely solely on the information in making any investment. You should always check with your licensed financial advisor to determine the suitability of any investments.