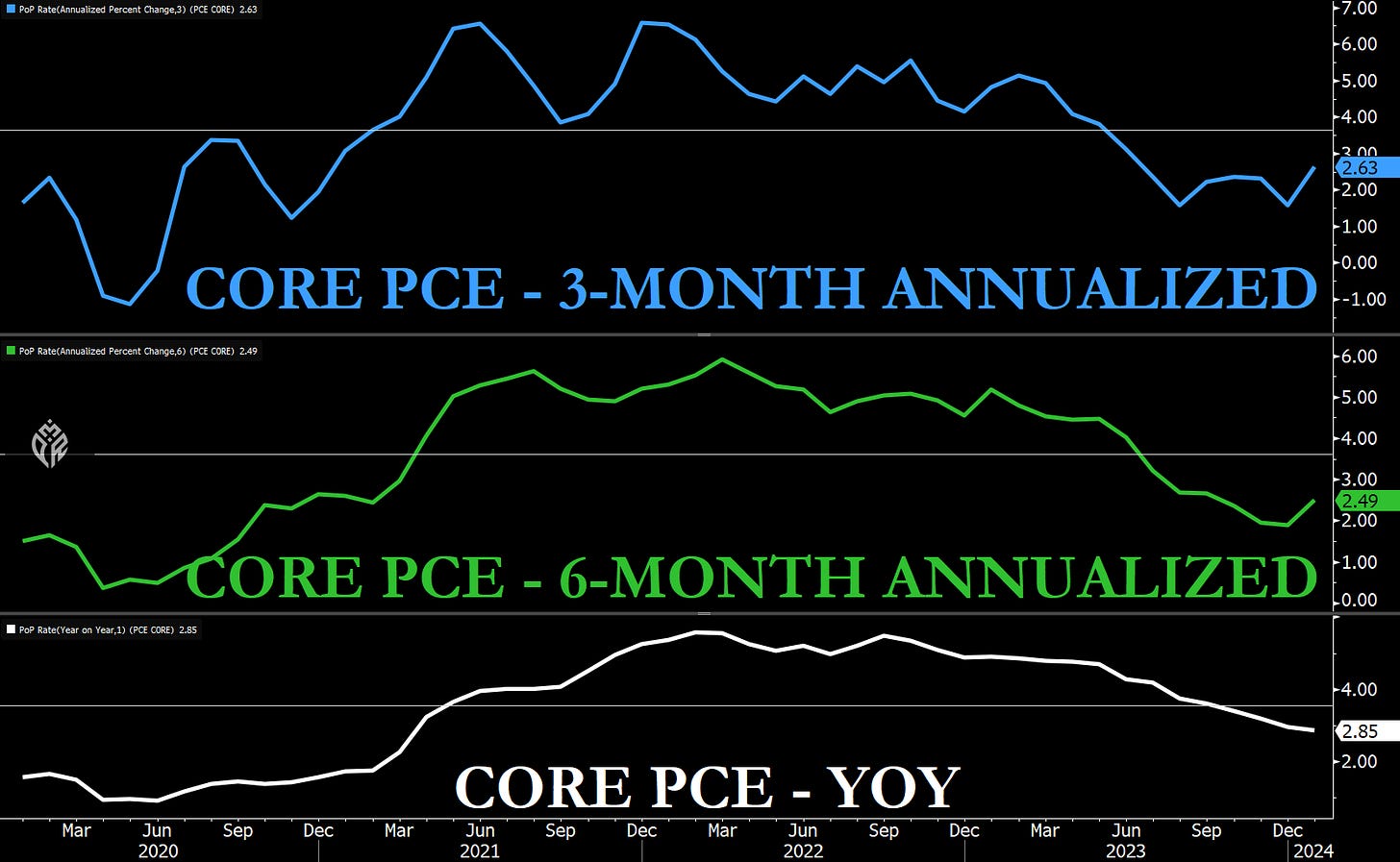

Core PCE stopped its progress toward target with the highest month over month print since January of 2023, the highest 3-month annualized print since June of 2023 and the highest 6-month annualized print since September of 2023. Also of note, supercore was over 4% on a 3-month annualized basis after being at 2.18% last month. This is bad for the Fed but is only one print and had some quirks like financial services driving a chunk of the gain that may not stick around. This does make the next CPI/PPI/PCE prints very important because if they are not cool, all the shorter term views will paint a clear picture of reacceleration.

Remember - we went from 17 FOMC members (all of them) down to 8 that see upside risks to PCE inflation.

Personal income had a substantial jump (well above expectations) but clear that cost of living jump for 2024 played a role here (see the JAN 2023 spike).

Jobless claims up and higher than expected but still not signaling much labor market weakness.

The Economic Surprise Index is still green and has jumped in recent weeks but is now a touch off the highs. Some of the housing data has been notably weak in recent prints.

Vol control was likely very supportive today for the first time in a while thanks to falling realized volatility.

John Comiskey (who you should read if you are an RRP/TGA nerd thinks we go longer than July.

Not shocking but folks are greedy right now.

Similar view from BofA.

I love this view from BofA that shows just how expensive markets are. I think there are solid arguments for why markets will stay expensive but the arguments that they are not in fact expensive, are silly.

*Could* feed into construction employment later in the year.

Japanese rates and breakevens have moved steadily higher for the last 3+ years and now with hikes looking likely before long - can we put in new highs? With that said, Japan’s most recent industrial production was awful so growth may still be a headwind here.

As of now, the 2024 deficit should be lower than last year’s.

The tax bills under consideration would make the deficit worse in the near term so while the deficit is tracking lower for 2024, Congress may still “fix” that this year.

This of course would add to growth (and probably inflation).

We have had a lot of tightening in this cycle - the problem is we have also had a lot of fiscal stimulus, Fed liquidity, and asset price inflation.

Goldmans thinks GLP-1s could raise GDP by 0.4% to 1%. I am not convinced on GLP-1s just yet in general but if they are what they are cracked up to be - I think the baseline is probably spot on. Excessive healthcare spending is a significant drain on the economy so it would unleash a lot of potential.

Something I covered in a recent Cascade - exports are really firming up out of Asia.

Good demographic breakdown of labor force participation.

This is something I have thought about a lot lately - interesting to see it on a chart. Rates have gone back up lately but we never got that much of a sales bounce even with the rates retreat. So if rates are sticky up here longer than expected - real estate may be in for a longer winter than expected.

Pretty stunning visual. The price we pay for growth compared to the price we pay for cashflow has wildly diverged.

War may be inflationary, but it is also a tailwind for growth.

An underrated part of the Dollar Milkshake Theory.

Disclosure: Pinecone Macro Research, LLC is an independent research firm. Pinecone Macro’s letters are based upon information gathered from various sources believed to be reliable but are not guaranteed as to accuracy or completeness. There are risks in investing. Any individual report is not all-inclusive and does not contain all of the information that you may desire in making an investment decision. You must conduct and rely on your own evaluation of any potential investment and the terms of its offering, including the merits and risks involved in making a decision to invest. The information in this letter is not intended to be, and shall not constitute, an offer to sell or a solicitation of an offer to buy any security or investment product or service. The information in this report is subject to change without notice, and Pinecone Macro Research, LLC assumes no responsibility to update the information contained in this report. There is risk in trading markets. Pinecone Macro Research, LLC is not an investment advisor. The ideas and trades I share are my own and are for informational and educational purposes only and should not be construed as investment advice. Accordingly, you should not rely solely on the information in making any investment. You should always check with your licensed financial advisor to determine the suitability of any investments.