The PMR Chartist #5

Best charts I stumbled upon today...

The data for yesterday and today.

ISM was weak today (S&P’s PMI was strong) with inventories being a big issue.

New orders minus inventories is still solid however, suggesting more upside is possible moving forward.

Hidden in today’s weak ISM: more industries growing than any time in 2023.

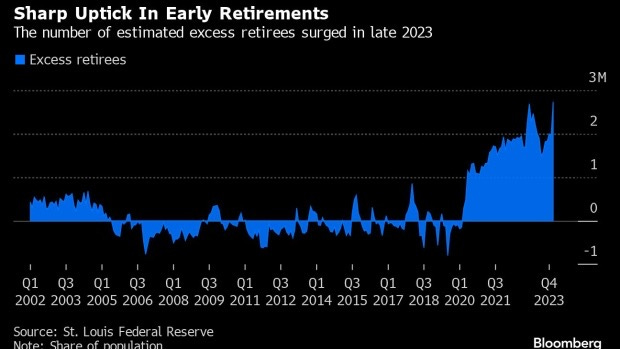

Not just Boomers retiring but Xers. This is another side effect of asset prices going through the roof - it allows a lot of folks to leave the labor force which of course is not deflationary!

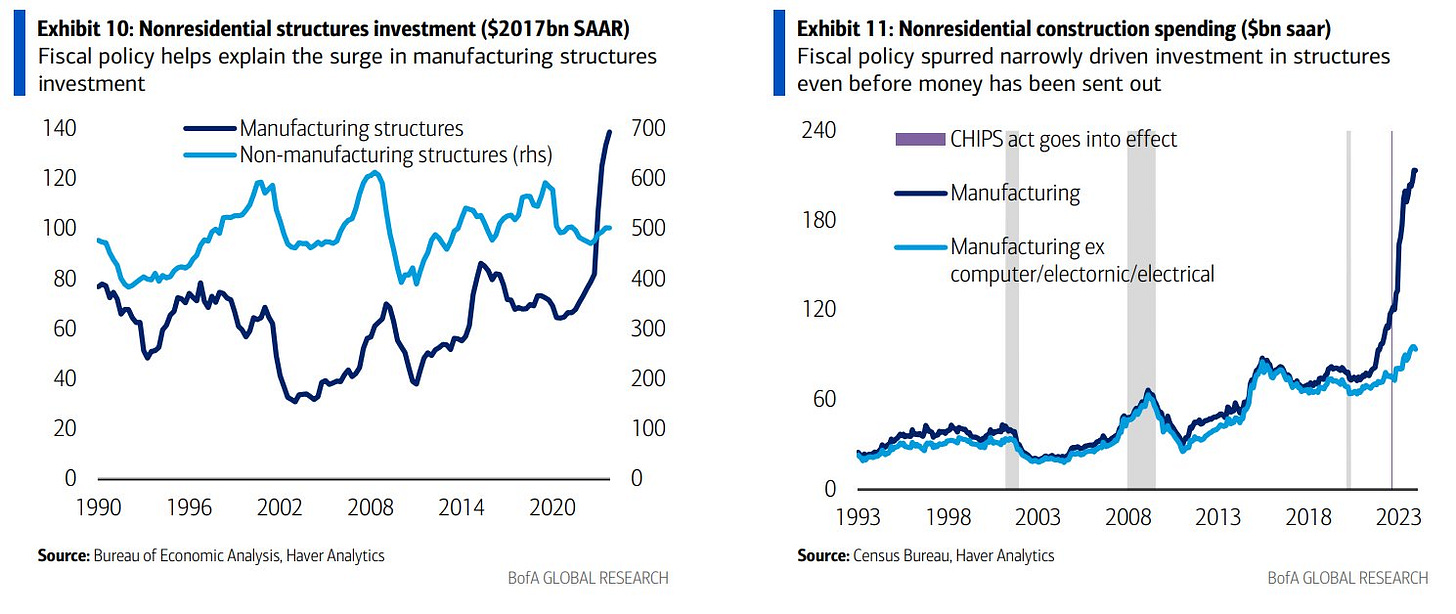

Chips aint cheap.

This is one of those things you read about and it is so wild you just cannot even grasp how this is *actually* made.

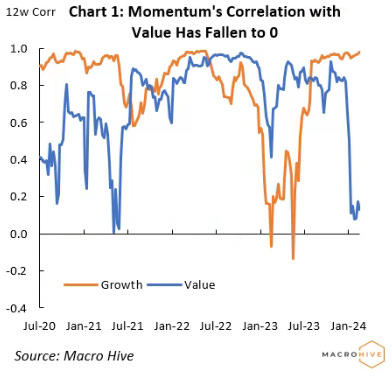

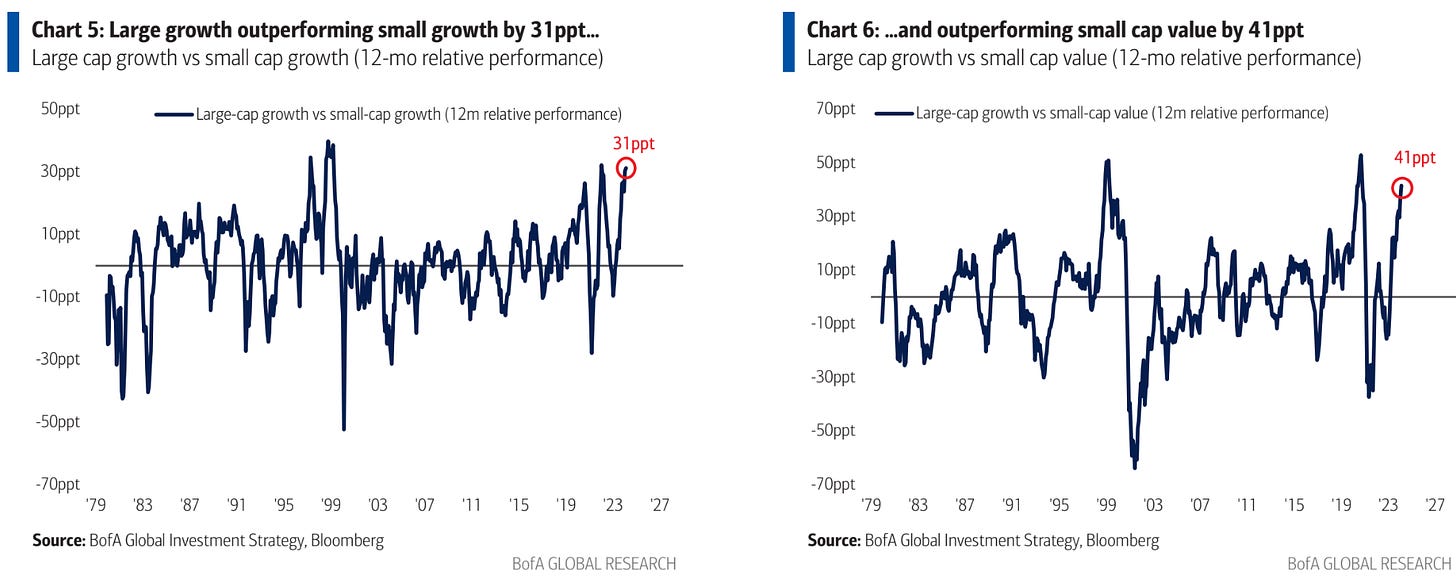

Momentum has been on fire but it is essentially all growth and no value. Will make for some fireworks in the future on a partial unwind of positioning.

A fall in household formation coupled with a huge pipeline of new homes and apartments is not a great combo for rents/prices. This is the area the disinflationists can point to firmly.

Starting to think the CHIPS Act stimulated construction a touch.

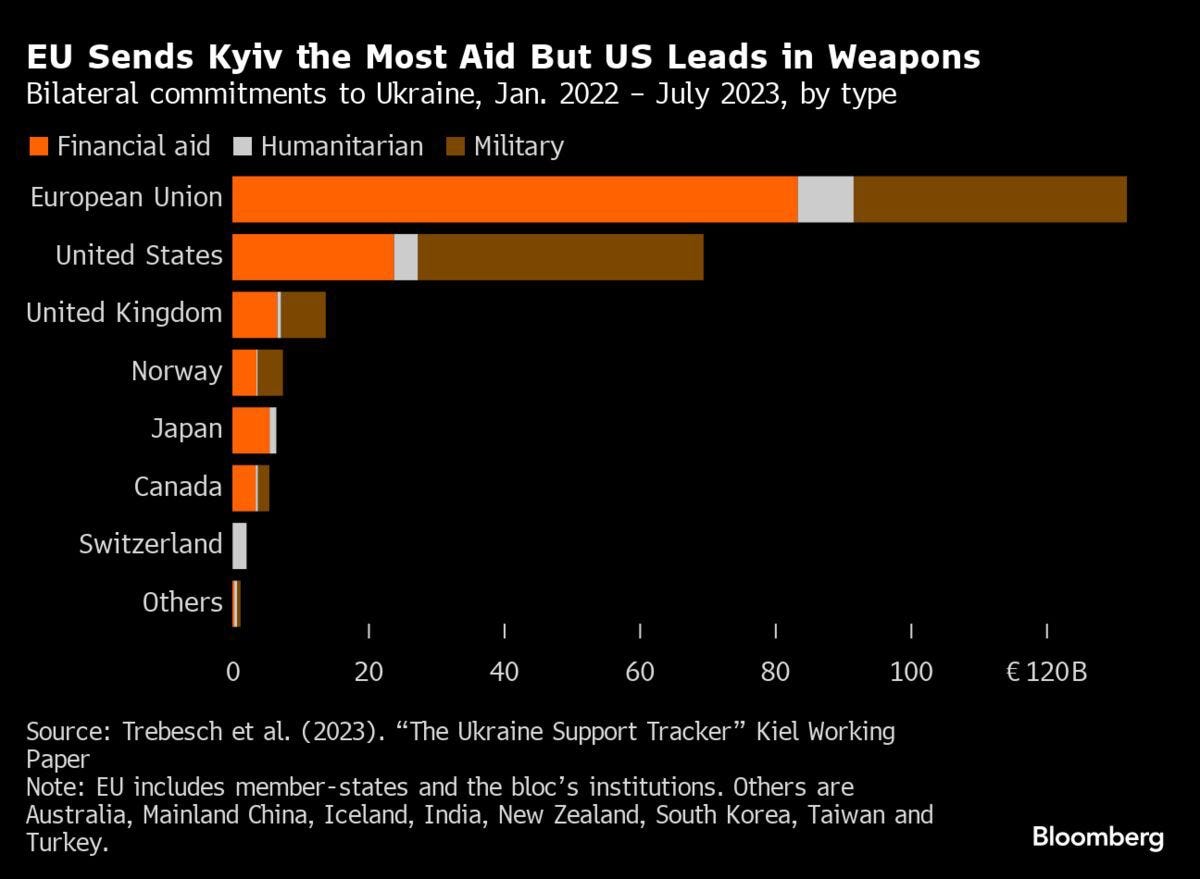

Good visual of support for Ukraine during the war.

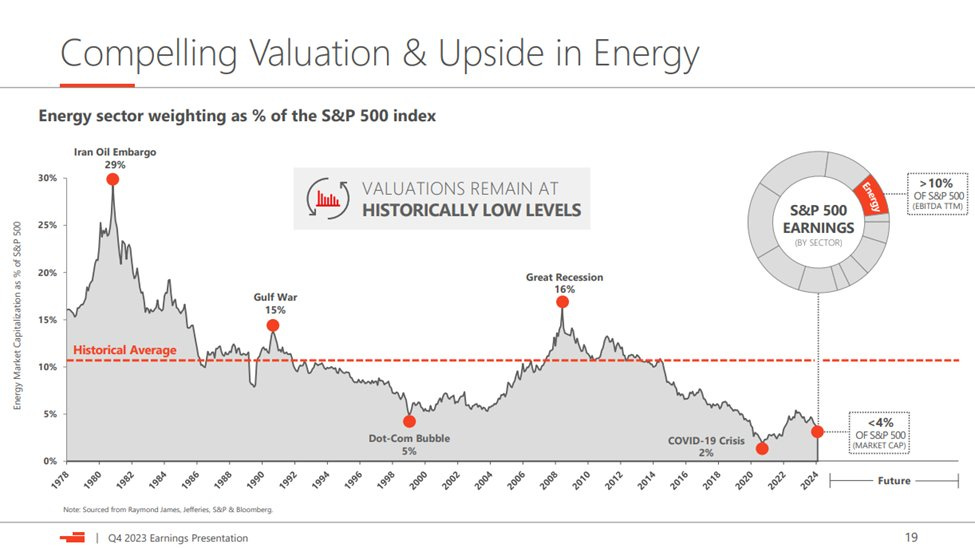

Energy is 10% of S&P earnings but only 4% of market cap.

Refinery Utilization has been very low so far this year - keeping oil inventories up but starting to drain products quickly.

Concentration may be justified to a degree - but it is still dangerous.

I am starting to think folks like tech stocks around here.

Great chart showing the recent surge in both service sector employment and service sector inflation. Fed happy to just look through this and talk past it right now but if January was not a one off (Feb does not need to be nearly as hot either) - the Fed will have a problem.

Looks like some other markets also dealing with concentration risks.

Naturally the one stock active likes has struggled.

We have had some “see QT does not hurt anything” victory laps of late but of course it did not hurt anything while adding net liquidity.

Disclosure: Pinecone Macro Research, LLC is an independent research firm. Pinecone Macro’s letters are based upon information gathered from various sources believed to be reliable but are not guaranteed as to accuracy or completeness. There are risks in investing. Any individual report is not all-inclusive and does not contain all of the information that you may desire in making an investment decision. You must conduct and rely on your own evaluation of any potential investment and the terms of its offering, including the merits and risks involved in making a decision to invest. The information in this letter is not intended to be, and shall not constitute, an offer to sell or a solicitation of an offer to buy any security or investment product or service. The information in this report is subject to change without notice, and Pinecone Macro Research, LLC assumes no responsibility to update the information contained in this report. There is risk in trading markets. Pinecone Macro Research, LLC is not an investment advisor. The ideas and trades I share are my own and are for informational and educational purposes only and should not be construed as investment advice. Accordingly, you should not rely solely on the information in making any investment. You should always check with your licensed financial advisor to determine the suitability of any investments.