The PMR Chartist #6

Best charts I stumbled on today...

Here is yesterday and today’s data.

Here is BofA’s current FOMC breakdown. Sorry but Goolsbee has worked his way to Full Dove in my view!

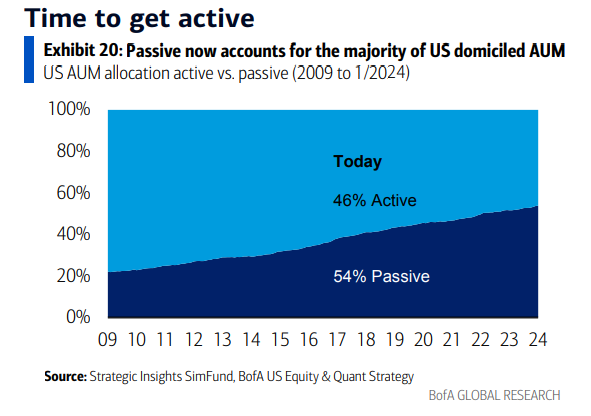

This explains a lot of the overvaluation and concentration many of us worry about today. The Industrial Retirement Complex and its passive flows along with systematic strategies hold immense explanatory power these days.

The flows into the new BTC ETFs has been very strong and is driving the boom in price.

The flows have been tech tech tech YTD.

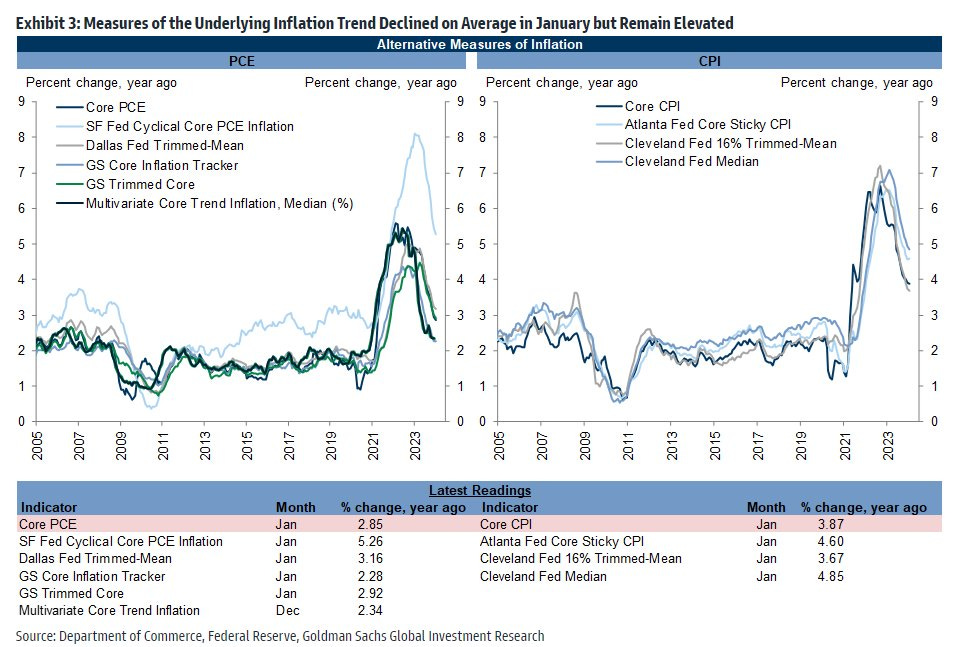

Exactly zero of the 10 measures listed are at or below 2.0%. Six of them however are above 3%. Getting markets juiced for 3+ cuts while enjoying that inflation backdrop and excess liquidity is a recipe for well…16 of 18 weeks higher for stocks and BTC mooning.

Housing data has been poor lately. If that trend continues - it is mixed with a backdrop of a ton of homes yet to hit the market which could be a bad combo.

Stock market internals are suggesting a better economy than recent economic data.

That is a lot of equity allocation. Households and foreign investors are in the 99th percentile going back to 1952 and pensions are 85th percentile.

Energy is incredibly cheap looking in this context.

Discussing AI has (not surprisingly) been good for returns.

M2 has gone up 3 of the last 4 months but is now “only 16%” above trend after peaking at about 31% above trend.

Ugly day for $TSLA…

The weekly chart of $APPL is now below the 33W and 50W, not to mention the big horizontal line that was right at those levels ($181).

Markets and the economy look great right now, but it is important to remember that their are some concerning pockets - like delinquencies for Millennials and Gen Z for instance.

Disclosure: Pinecone Macro Research, LLC is an independent research firm. Pinecone Macro’s letters are based upon information gathered from various sources believed to be reliable but are not guaranteed as to accuracy or completeness. There are risks in investing. Any individual report is not all-inclusive and does not contain all of the information that you may desire in making an investment decision. You must conduct and rely on your own evaluation of any potential investment and the terms of its offering, including the merits and risks involved in making a decision to invest. The information in this letter is not intended to be, and shall not constitute, an offer to sell or a solicitation of an offer to buy any security or investment product or service. The information in this report is subject to change without notice, and Pinecone Macro Research, LLC assumes no responsibility to update the information contained in this report. There is risk in trading markets. Pinecone Macro Research, LLC is not an investment advisor. The ideas and trades I share are my own and are for informational and educational purposes only and should not be construed as investment advice. Accordingly, you should not rely solely on the information in making any investment. You should always check with your licensed financial advisor to determine the suitability of any investments.