The PMR Chartist #7

Best charts I stumbled upon today...

China’s inflation goal this year is around 3% which at the moment feels like a tall task.

Good chart from Barry Knapp on small business employment. The economy has been incredibly strong and financial conditions suggest it can stay that way for a bit - BUT - small business, small banks, and young consumers have a lot of significant headwinds as short term rates reach out and touch more and more folks.

Services ISM Employment now under 50 two of the last three months.

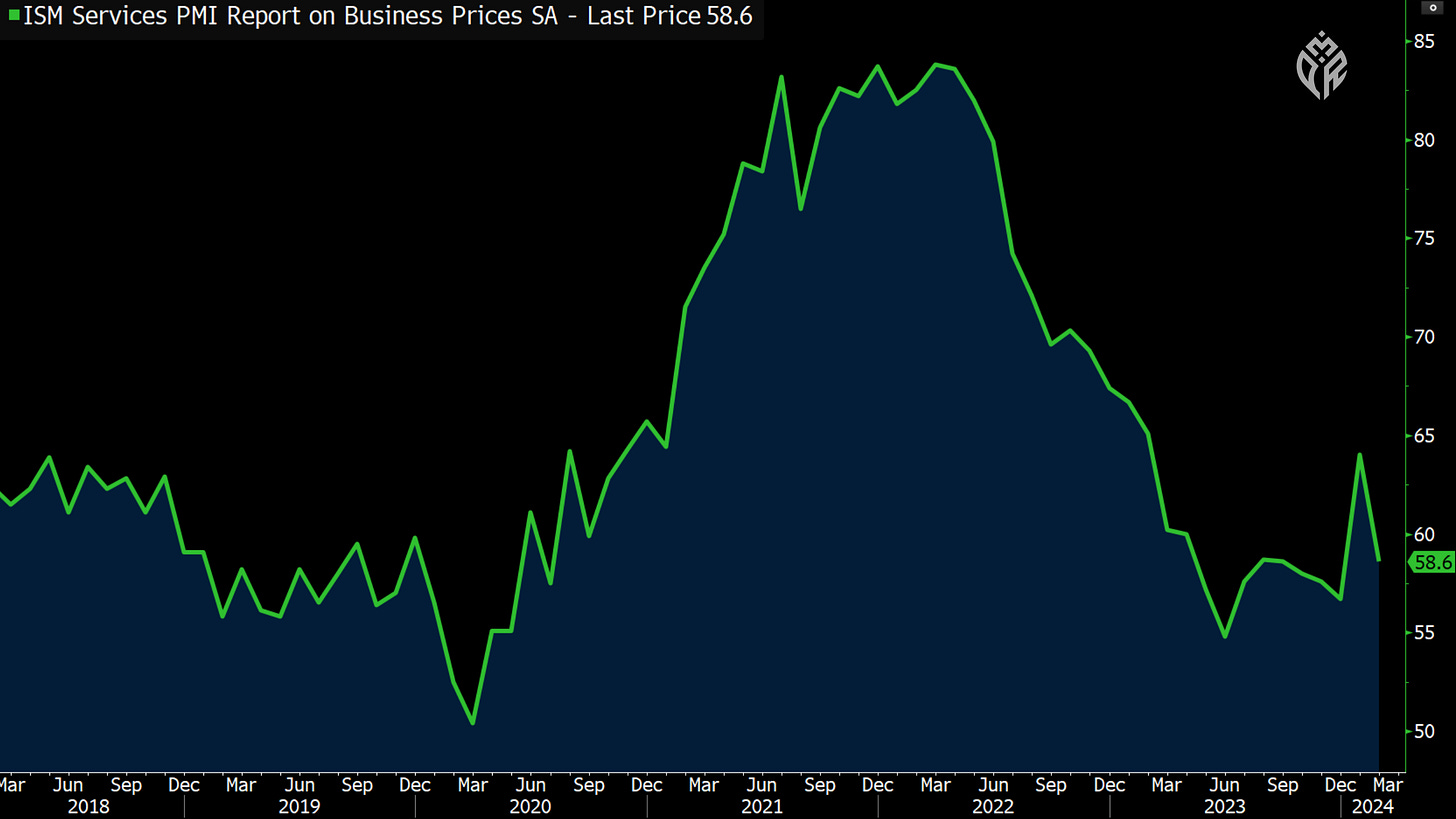

Perhaps more important for our inflation watch - the big jump in prices paid dialed it back below 60 (not that 58 is low but it IS below the 10yr average of 61).

The number of industries reporting growth looked a bit scary a couple of months ago but is now back up to 14.

New orders were the highest since August which felt important to me despite headline being cooer than expected.

The 1yr inflation swap is now 63bps off the lows and suggesting the Fed is just wrong about hitting their target any time soon. So far - no sign they care really.

Goldman thinks Core PCE will hit 2.3% in 2024 and I am not convinced. One of the reasons I am not convinced is outlined beautifully in this chart by…Goldman Sachs.

Looking at markets lately - it feels like one big bet that this move in January was not just half wrong but worth fully ignoring. Maybe, but that sure feels like a risky bet to me.

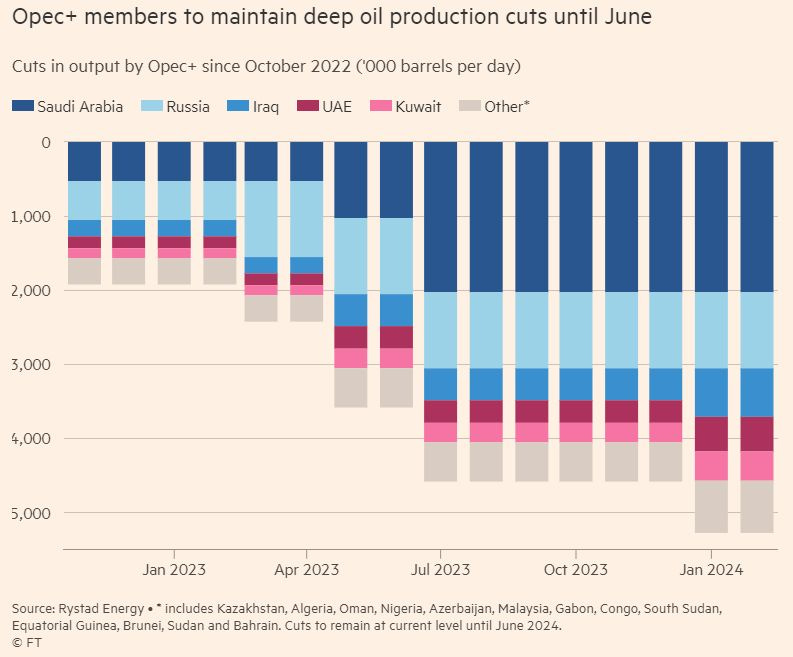

Good view of the OPEC+ cuts. A lot of folks talking about how unsustainable this is and the risk of it blowing up overnight. It was never meant to be sustainable - just a bridge to let demand catch up. It will and they will raise production once it does.

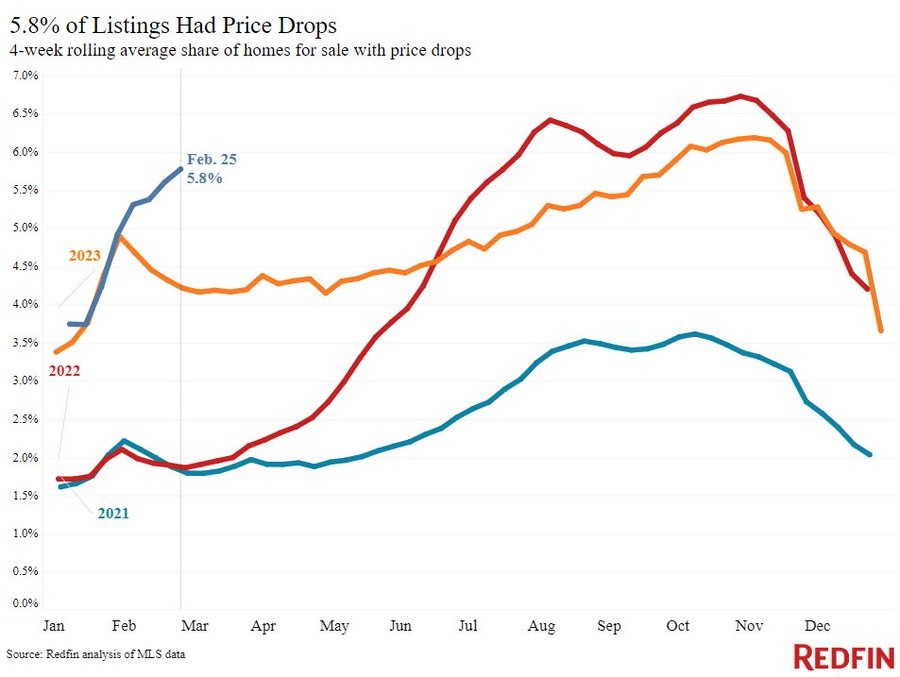

Housing is weak. Big jump in the number of listings with price cuts.

Potentially an important/informative look into NVDA supply/demand.

Cool view of 5% pullbacks going back to the Depression.

Argentine stocks are at a very important level on the chart here.

Disclosure: Pinecone Macro Research, LLC is an independent research firm. Pinecone Macro’s letters are based upon information gathered from various sources believed to be reliable but are not guaranteed as to accuracy or completeness. There are risks in investing. Any individual report is not all-inclusive and does not contain all of the information that you may desire in making an investment decision. You must conduct and rely on your own evaluation of any potential investment and the terms of its offering, including the merits and risks involved in making a decision to invest. The information in this letter is not intended to be, and shall not constitute, an offer to sell or a solicitation of an offer to buy any security or investment product or service. The information in this report is subject to change without notice, and Pinecone Macro Research, LLC assumes no responsibility to update the information contained in this report. There is risk in trading markets. Pinecone Macro Research, LLC is not an investment advisor. The ideas and trades I share are my own and are for informational and educational purposes only and should not be construed as investment advice. Accordingly, you should not rely solely on the inform