Unlocked Report - 1998

What cutting into strength can look like

I have a lot of new free subscribers that I have picked up this year and I wanted to thank you for taking the time to read the snippets of my work. Given the absurd amount of information and entertainment competing for our attention - I consider every word you all read of my work to be a minor miracle. Once in a while I like to give away some milk for free by unlocking an old letter I wrote that has become more relevant since I wrote it.

Back at the beginning of the year, I wrote an Emerald about what the Fed did in 1998 and how I thought we could be heading down the same path in 2024. With this week’s jumbo interest rate cut and projections for many more cuts over the next year or two - I think what I wrote 8 months ago is more important than when I wrote it. I think you will find the parallels striking.

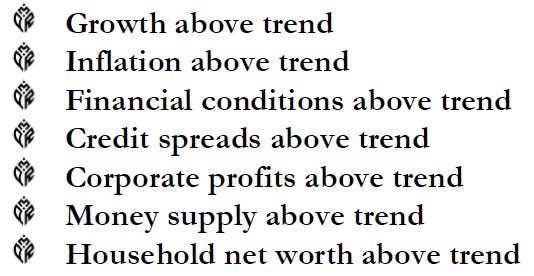

Now this report is 8 months old so some stuff has changed so keep that in mind. In the report I express my concern over the Fed cutting into strength and I think the bullet points below capture why I think they clearly just did that. This is the backdrop they just cut into and this does not even include the 7% of GDP deficit so add that to the list…

You can read the report below and if you like it, share it. If you love it, consider signing up for our paid Substack or better yet signing up for The Cascade or The Emerald on the website. Thank you!

You said the magic word "money printing" vs "QE" is an important topic of mine. I am trying to get my head around it, but not sure where to get the data from :)

Could you please clarify what you mean by that?

"We barely even had a deficit in 1998 and now it is 6.3%, which of course is

actual money printing unlike QE – so you have a deficit and asset prices both

pushing the real economy higher while the Fed still thinks the neutral rate is

2.5%. They are going to learn the hard way that it is higher"

As far as I understand, the deficit is not necessarily money printing.

Example: The government borrows the 6.3% deficit. The lender is either non US entities or US entities (other than the FED). If the FED, then it is money printing I would say? If it is not the FED, then it's just existing money that is lent to the government. There is no money printing, YET. :)

A lot of non-US entities would lend to the government (say the Japanese). Even the Chinese and pocket the difference. That is the carry trade on a sovereign level.

Is this incorrect? If so, then how do you know it is money printing - where do you get the data from? :)

It's all about the data :-)

Thank you.

Thank you !